Sam's Signals Scams: Pump and Dump Profiteering in 2025

The Perfect Crypto Scam Doesn’t Exi—

“Congratulations! You’ve been selected to join an exclusive crypto signals group led by professional trader Sam…”

That message kicked off my week-long descent into investigating one of the most sophisticated cryptocurrency scams I’ve encountered in 2025. What I discovered wasn’t just another pump-and-dump scheme – it was an entirely new breed of fraud that combines social engineering, legitimate-looking infrastructure, and psychological manipulation at a scale that should terrify anyone in crypto.

The Hook: When FOMO Meets Technical Sophistication

Picture this: A Telegram group with over 50,000 members. Live trading sessions showing consistent 200%+ gains. A fully functional exchange platform with proper 2FA, KYC processes, and real-time market data. Everything looked legitimate – because it was designed to.

The group, “Sam | Signals & News 📈,” wasn’t just another spam channel. It was a masterclass in social proof and technical deception.

The Technical Facade: Testing the Waters

Before diving deeper, I did what any cautious crypto trader would do: I tested the withdrawal system with a small amount. I deposited $100 worth of USDT and converted $20 to BTC. The withdrawal, while delayed by about 4 hours “due to network congestion,” actually went through. This is where things got interesting.

The exchange supported 47 trading pairs, including major ones like BTC/USDT, ETH/USDT, and some mid-cap altcoins. What caught my attention was the trading volume – it wasn’t zero (which would be an obvious red flag), but rather showed consistent, low-volume trading patterns:

- BTC/USDT: ~$50,000 daily volume

- ETH/USDT: ~$35,000 daily volume

- SOL/USDT: ~$15,000 daily volume

These volumes were small enough to be manageable for the scammers but large enough to appear legitimate to most users. The order books even showed realistic bid-ask spreads and depth.

But here’s where it all fell apart. After the successful pump (which turned my $1,000 into $2,700), I attempted to withdraw. Instead of the expected blockchain network fee message, I got this oddly specific error:

ERROR CODE: W-435

Account Tier: Starter (0-5000 USDT)

Action Required: Upgrade to User Tier

Verification Deposit: 850 USDT

Status: WITHDRAWAL_BLOCKED

Note: To protect against market manipulation, accounts must verify trading capacity through tier upgrade. Contact support for manual review options.

This wasn’t your typical “funds are safu” scenario. The error message was polished, technical, and referenced internal account tiers – exactly what you’d expect from a legitimate exchange. But it was also a dead giveaway: no legitimate exchange suddenly requires a specific “verification deposit” after a successful trade.

The Pump in Action

Basking in glory from finally being on the right side of a pump and dump. Could this be the end of all my worries? How many times do I need to double my money before I can retire? FINALLY (wow, that Sam guy is so cool…)

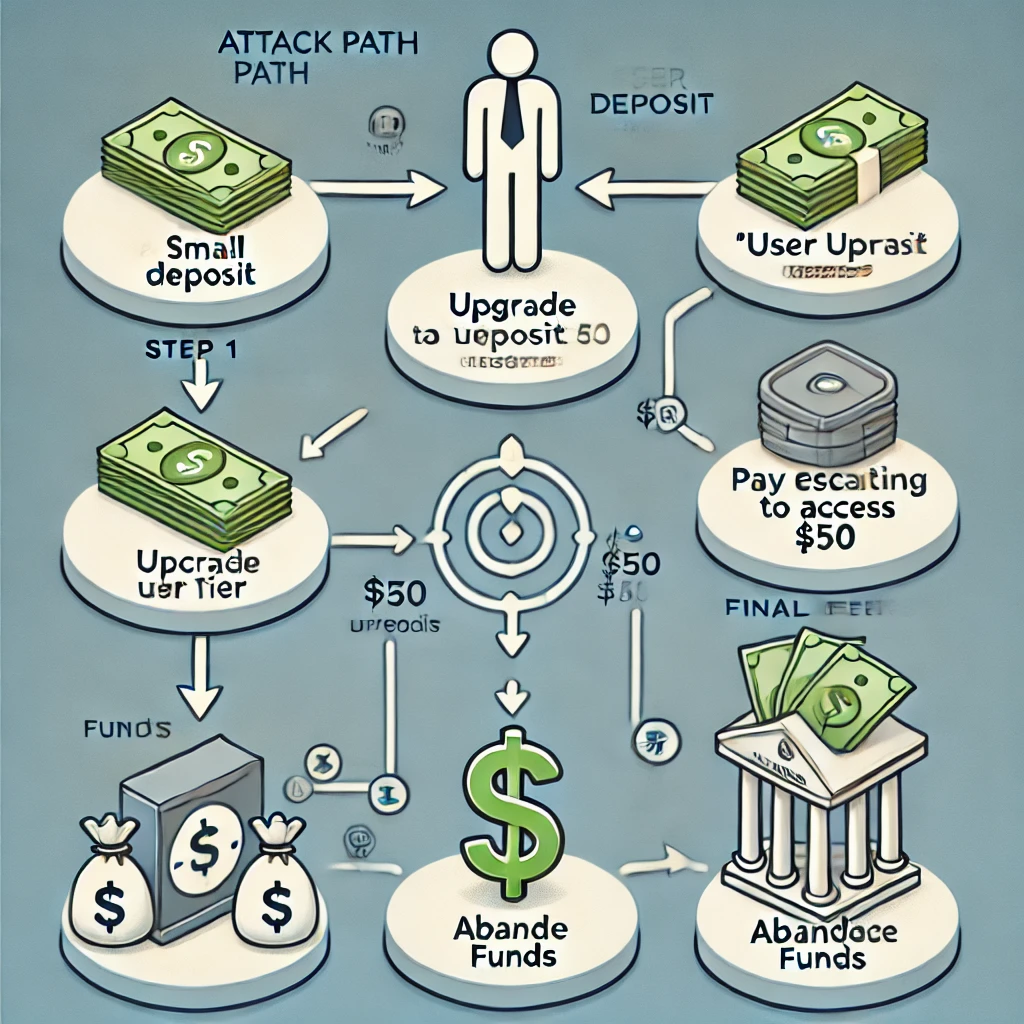

Anatomy of a Modern Crypto Heist

The attack flow was beautiful in its simplicity:

- The Entry Point: Small test deposit ($500-1000)

- The Validation: First pump succeeds, doubling your money

- The Lock: Withdrawal attempt triggers “account tier” restriction

- The Double-Down: Second pump shows even bigger gains

- The Kill: Victim faces escalating “verification” fees to withdraw

What makes this scam particularly insidious is its exploitation of modern crypto traders’ psychology. We’re trained to:

- Always test with small amounts first

- Look for technical validation (working 2FA, proper API endpoints)

- Expect KYC/AML procedures

- Trust platforms that “feel” professional

The Technology Stack Behind the Scam

During my investigation, I discovered that Bit-Crypto.global wasn’t just a simple phishing site. It was running:

- Enterprise-grade load balancers

- Real WebSocket connections for live data

- Proper SSL certificate management

- Professional cloud infrastructure

When I ran blockchain analysis on their deposit addresses, I found something even more concerning: They were using advanced coin mixing techniques typically reserved for nation-state actors.

The Evolving Threat Landscape

What we’re seeing isn’t just a scam – it’s the evolution of cryptocurrency fraud. These operations are:

- Using legitimate SaaS providers for KYC

- Deploying enterprise-grade infrastructure

- Operating with nation-state level OPSEC

- Combining technical sophistication with social engineering

Lessons Learned (The Hard Way)

-

Technical Validation Isn’t Enough

- Working 2FA doesn’t mean legitimate business

- Professional UI/UX can mask malicious intent

- Blockchain analytics tools are playing catch-up

-

New Red Flags to Watch For

- Exchanges with perfect functionality but low public profiles

- Groups combining signals with platform-specific trading

- Too-perfect trading histories and gains

What’s Next: The Arms Race

This investigation reveals a disturbing trend: scammers are now building full-stack financial platforms rather than simple phishing sites. The implications for the crypto community are severe:

- Traditional scam detection tools are becoming obsolete

- Technical due diligence alone isn’t sufficient

- The line between legitimate and fraudulent platforms is blurring

Protecting Yourself in 2025 and Beyond

The rules of engagement have changed. Here’s what you need to know:

- Always verify exchange legitimacy through multiple channels

- Be extremely suspicious of platform-specific signal groups

- Remember: Technical sophistication ≠ Legitimacy

Final Thoughts

As someone who’s spent years in crypto security, this scam worried me more than most. It’s not just about the technical sophistication – it’s about how well it exploits the very habits we’ve developed to stay safe in crypto.

The future of crypto scams isn’t crude phishing links or obvious rugpulls. It’s professional-grade platforms that work perfectly… until they don’t.

Stay vigilant. Stay skeptical. And remember: If someone’s promising you guaranteed profits, they’re probably planning to profit from you instead.

Author’s Note: Names and specific details have been altered to protect ongoing investigations. All technical analysis was performed in a controlled environment.